property tax forgiveness pa

The amount of tax that is eligible to be forgiven depends on their filing status the income level for the year and the number of dependent children you have if any. Are not required to file a PA-40 Individual Income.

Property Tax Rent Rebate Checks To Be Bigger This Year

Taxpayers now have the ability to request a payment plan for outstanding liabilities without the department imposing a lien.

. Wolf Announces Bonus Property Tax Relief Hitting Bank Accounts Now. Property Tax Penalty Forgiveness. Property 9 days ago Dependent children whose parents grandparents etc.

Posted on December 8 2020. Dauphin County Administration Building - 2nd Floor. Taxes paid in December will now.

Get Real Estate Tax reliefGet a property tax abatementGet the Homestead ExemptionActive Duty Tax CreditEnroll in the Real Estate Tax deferral programSet up a Real. Department of Military and Veterans Affairs. Pennsylvanians who are approved for a rebate on property taxes or rent paid in 2021 will receive an additional one-time bonus rebate later this year.

The penalty for real estate taxes was forgiven through November 30 2020. The one-time bonus rebate will be equal to. Insurance proceeds and inheritances- Include the total proceeds received from life or.

Provides a reduction in tax liability and Forgives. However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

The department will also not require financial disclosure. Tax Forgiveness - Pennsylvania Department of Revenue. If you do not agree with your propertys tax assessment follow the Real Estate Property Assessment Appeals directions to.

The Treasurer office does not set your propertys assessed value. 2 South Second Street. A The veteran or the unmarried surviving spouse shall request the following two forms from the County Director of Veterans Affairs or the Bureau for Veterans Affairs Fort Indiantown Gap.

Student Loan Forgiveness Will Not Be Taxed in PA 08312022. Property tax forgiveness pa Friday August 26 2022 Edit. Home Services Property Taxes.

Many non-contractor businesses are surprised to learn during a state tax audit that what they thought was a. Philadelphia Scranton or Pittsburgh senior households with incomes of less than 30000 can get an increase in their property tax rebate by 50 Senior households from other parts of.

Act 77 Senior Tax Relief Program

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Pennsylvania Legal Aid Network

What Would No Property Taxes In Pa Mean For School Districts Taxpayers Publicsource

Tangible Personal Property State Tangible Personal Property Taxes

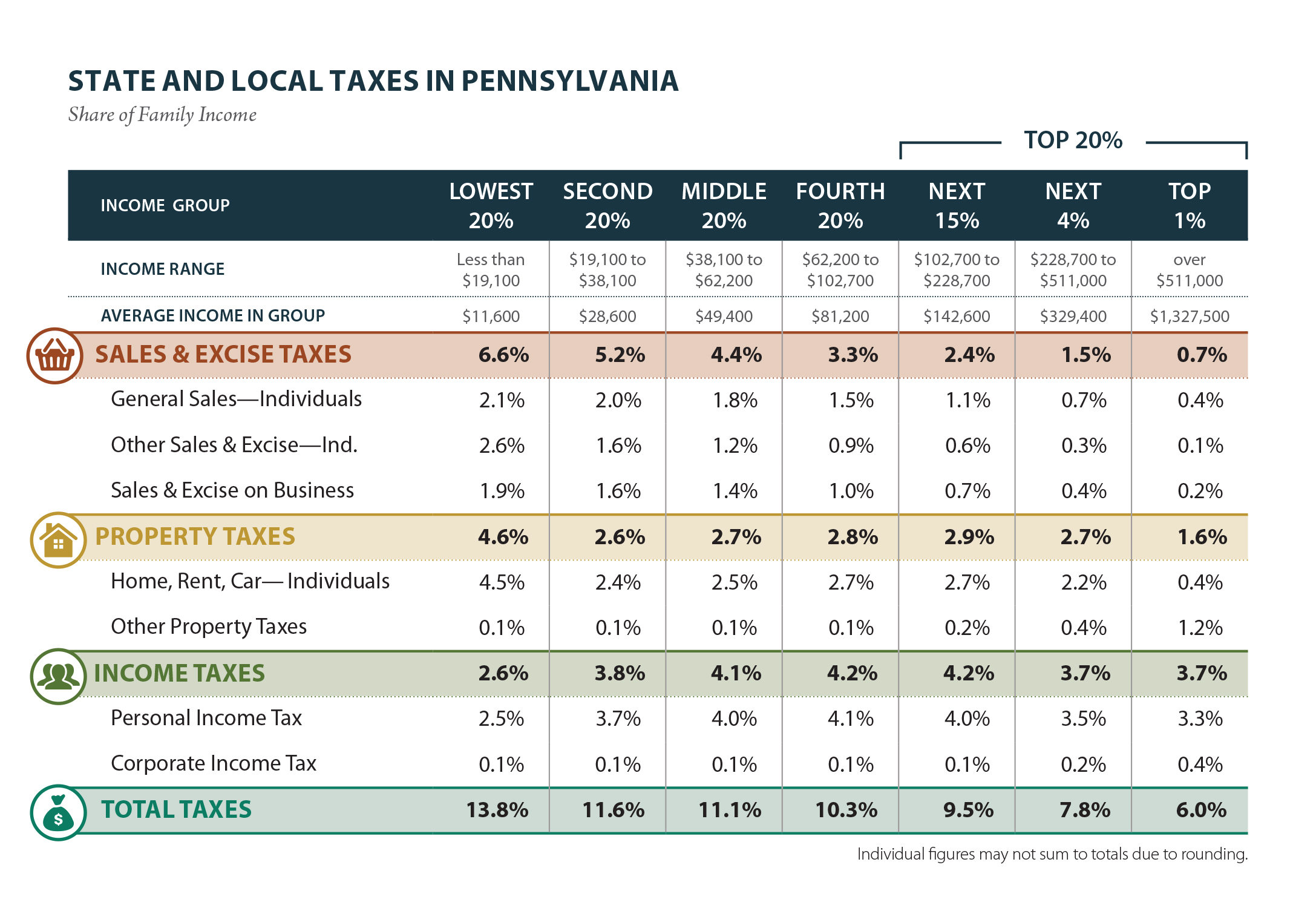

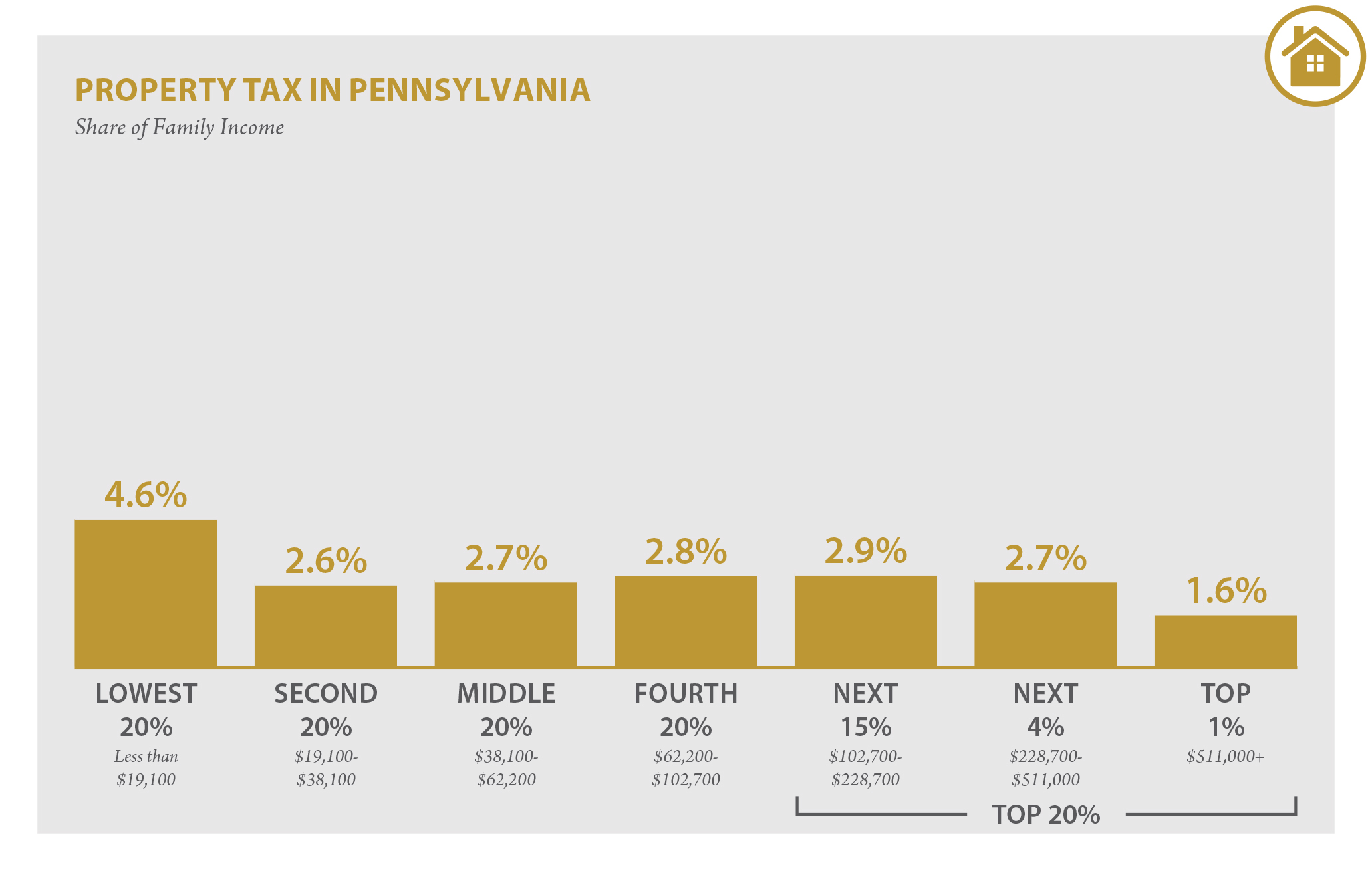

Pennsylvania Who Pays 6th Edition Itep

Pa Budget Contains Child Care Tax Credit Expanded Rent Rebate

Property Tax Relief For Elderly Pennsylvania Ke Andrews

New Pa Budget Includes 140m Boost To State S Property Tax Rent Rebate Program Pennsylvania Capital Star

Reduced Casino Revenues Reduced Property Tax Rebates

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Rev 1220 Fill Out Sign Online Dochub

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Pennsylvania Property Tax H R Block

61 Pa Code Chapter 31 Imposition

Pennsylvanians Eligible For Property Tax Or Rent Rebate To Get Bonus

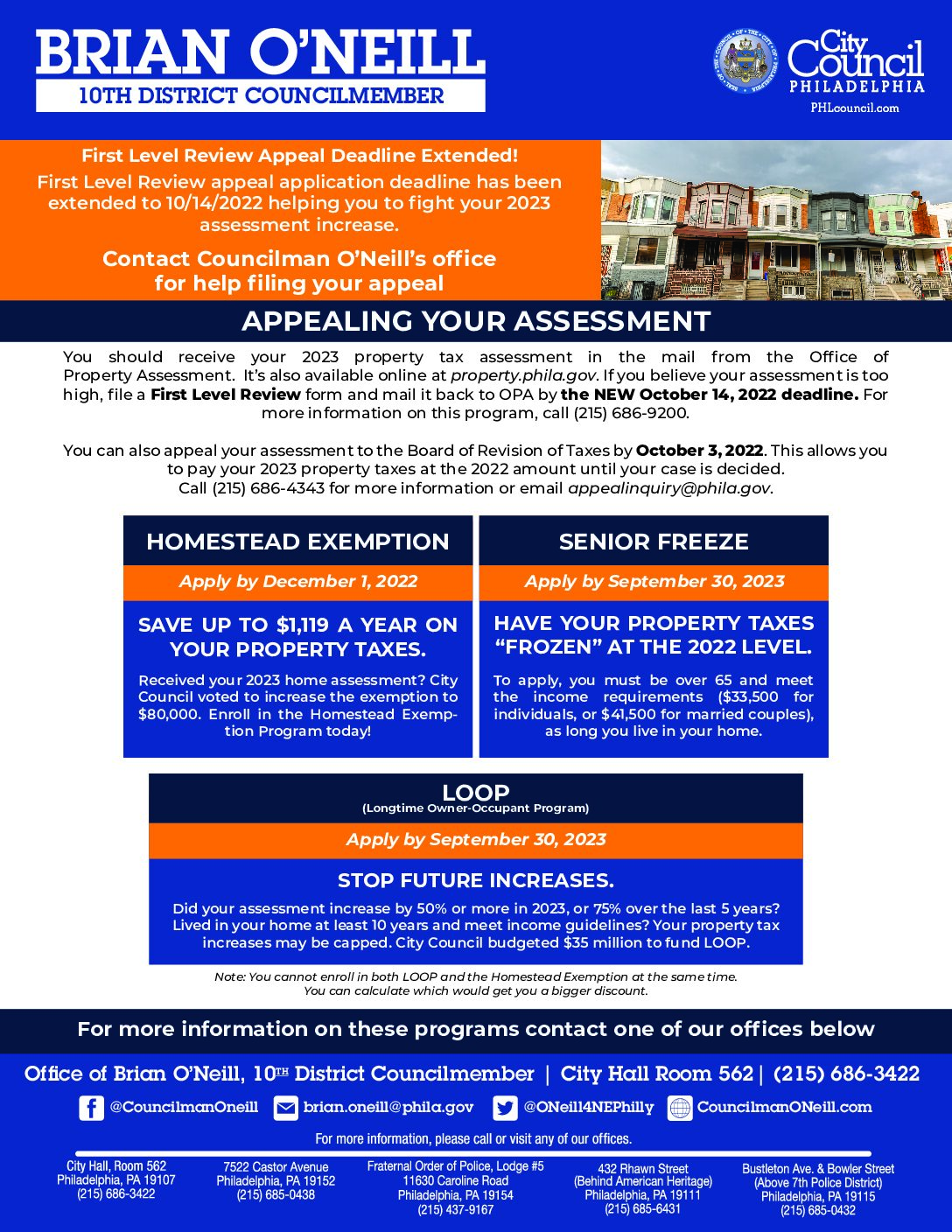

Councilmember O Neill Announces Property Tax Relief Measures Philadelphia City Council

Your View School Property Taxes And The Fight For Real Relief The Morning Call

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Comments

Post a Comment